This project set out to offer an informative dashboard to assist potential investors in making better financial decisions. The dashboard provides the user with structured information about a company, including recent news and updates, automated analyses of social media sentiments, and sector-specific knowledge, among other features.

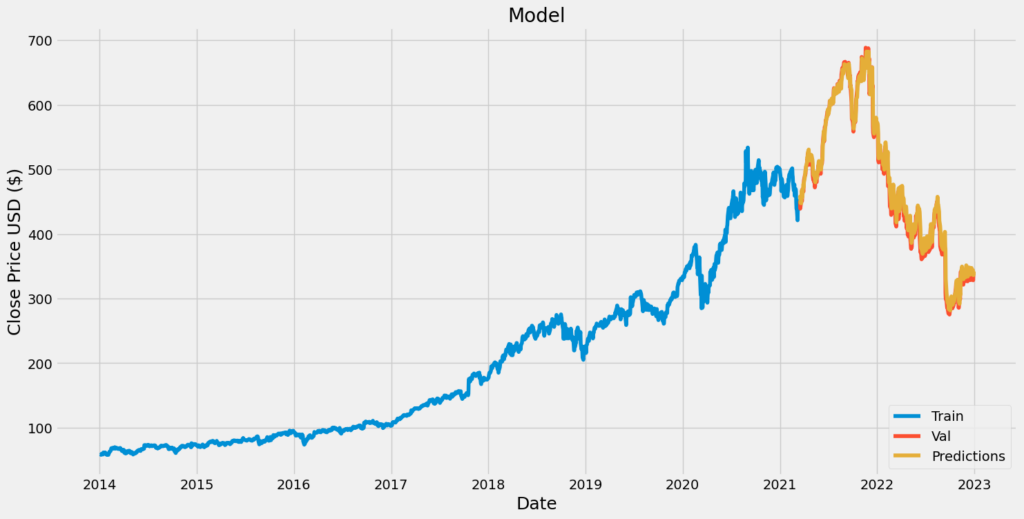

The project’s primary focus was to prioritise the most valuable features on the dashboard, using industry guidelines to present the relevant information meaningfully. Additionally, machine learning (ML) techniques, such as long short-term memory (LSTM), XGBoost, and natural language processing (NLP) for the purpose of sentiment analysis, were employed to analyse and predict stock prices, thus being additionally useful to investors.

The project also sought to make stock analysis and prediction accessible to a broader range of users, including those without a strong finance or technical background. To this end, the study also incorporated an evaluation of the effectiveness of the dashboard through a comparison with existing literature on stock analysis and commercial dashboards. This ensured that the information presented would be in line with expected industry standards.

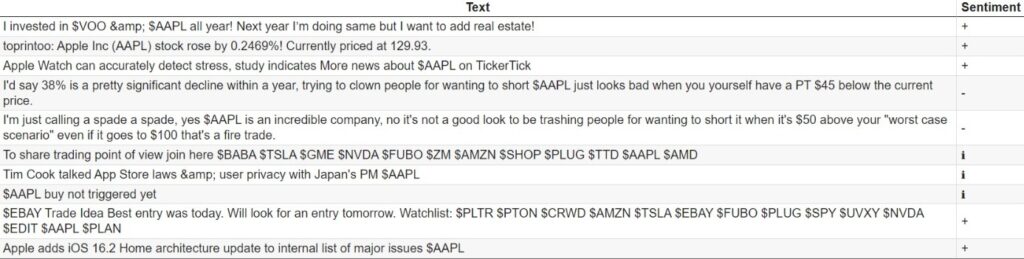

The process entailed measuring the accuracy of the predictions through a comparison with actual stock prices and by calculating metrics such as root-mean-square error (RMSE) and mean absolute percentage error (MAPE). The performance of the sentiment analysis feature was also evaluated. This was done by using a dataset of financial social media posts and news articles. Preliminary results showed that the analyser accurately distinguished between the positive and negative posts, thus confirming the potential of the chosen approach as a helpful investment-allocation strategy tool.

The project contributes towards improving capital allocation and investing decisions by minimising investor uncertainty and providing a helpful tool for financial decision-making.

Figure 1. LSTM Model on 3M stock

Figure 2. Twitter sentiment on the acronym ‘AAPL’ (which stands for Apple Inc.)

Student: Andrea Fenech Cesareo

Supervisor : Mr Joseph Bonello